If you have ever heard people talking about the value of the U.S. dollar and how it compares to other currencies, then you may be aware of the U.S. Dollar Index (USDX). It is a measure used to gauge the strength or weakness of our currency against six major foreign currencies. This index highlights essential changes in global markets backed by fundamental principles that provide investors with key insights into where they stand financially and why they should keep an eye on these exchanges. And here's why understanding USDX could help you stay more informed when making financial decisions!

U.S. Dollar Index (USDX):

The U.S. Dollar Index (USDX), sometimes referred to as the DXY, is a valuable tool for traders and investors. It measures the relative value of the U.S. Dollar against a basket of other currencies, which are weighted according to their importance in international trade and their size relative to the U.S. economy. The USDX provides a quick way to assess how well the Dollar performs compared to its foreign counterparts.

How Does it Work?

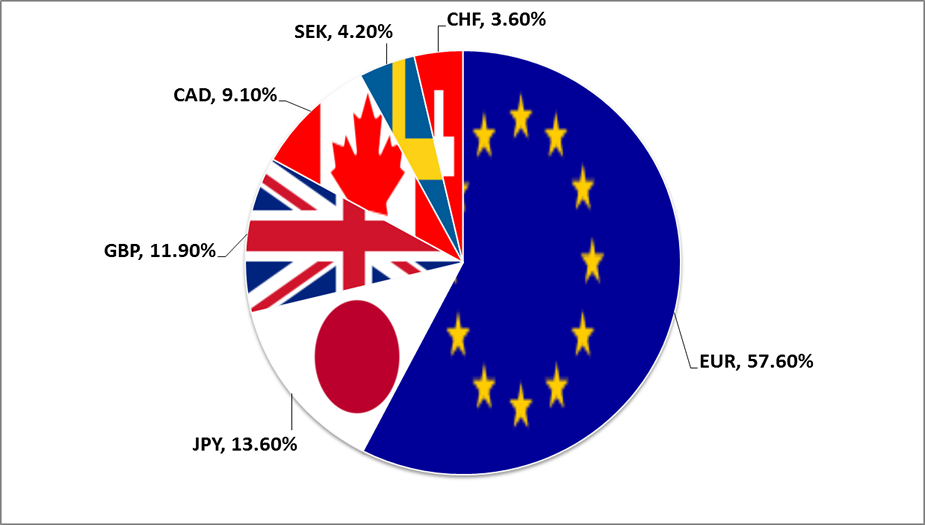

The USDX is calculated using six currencies based on their relative importance in international trade and finance. The Euro has the most significant weight at 57.6%, followed by the Japanese Yen (13.6%), British Pound Sterling (11.9%), Canadian Dollar (9.1%), Swiss Franc (4.2%), and Swedish Krona (3.6%). This means that if one currency increases in value against another, then the USDX will also increase correspondingly, and vice versa - when one currency falls, so does the USDX index and vice versa.

How is the USDX calculated?

The USDX index is calculated using a formula that considers the exchange rates of the six foreign currencies against the U.S. Dollar. To calculate it, the exchange rate for each currency is multiplied by its weighting factor (the percentage previously mentioned). Then all six figures are added to give an overall value for the index.

What Does USDX Tell Us?

The USDX can indicate how strong or weak our currency is compared to other major currencies. If our Dollar is weakening against those currencies, this could indicate that economic growth in the United States may not be as robust as expected. On the other hand, if our currency strengthens, there may be increased confidence in the U.S. economy and increased demand for products and services exported from the United States.

The USDX can also be used to assess changes in global currency markets, such as when there is a divergence between two currencies or when one currency is surging or falling against another. By tracking these movements regularly, investors can gain valuable insight into which way the overall market may be heading and whether they should make any adjustments to their portfolios.

What are some of the factors that can affect the USDX value over time?

The USDX can be affected by a wide range of internal and external factors.

Internally, changes in U.S. economic policy, such as interest rates or inflation rates, can cause the value of the U.S. dollar to rise or fall against other currencies.

Externally, events taking place worldwide, such as political turmoil or trade disputes between countries, can also affect the relative values of different currencies against each other. Additionally, global financial markets have a ripple effect on currency exchange rates that can ultimately influence the overall value of the USDX index.

What implications does the USDX have on global markets and economies?

The USDX provides investors and traders with a valuable tool to assess overall market sentiment and make informed investment decisions. By tracking the index, they can understand how the U.S. economy is performing compared to its international counterparts. This knowledge can help them make smarter investment choices, such as when to buy or sell certain assets or currencies or diversify their portfolios by adding other investments, such as bonds and commodities.

Overall, the USDX is an essential tool for everyone who follows global financial markets as it helps them stay informed on currency movements and better understand the potential implications of those movements on their investments.

Strategies to use when trading with or against the U.S. dollar index:

When trading with the U.S. dollar index, it is essential to consider various factors affecting its value. For instance, economic data released from the U.S. and other countries, such as unemployment figures or GDP growth rates, can impact the relative strength of one currency against another. Political events or developments in global markets can also influence currency exchange rates and therefore affect the USDX.

Investors should use technical analysis techniques such as trend lines and support/resistance levels to make successful trades to identify potential turning points in the index's movements. They should also monitor news sources for any major announcements that could cause sudden shifts in the index's value.

Conclusion:

The U.S. dollar index (USDX) is an important metric that can be used to assess the strength of the U.S. dollar relative to other major world currencies. By tracking this index, investors and traders can gain valuable insight into how the U.S. economy is performing compared to its international counterparts. Additionally, they can use various strategies such as technical analysis and monitoring news sources to try and capitalize on the movements of the USDX.

FAQs:

- Q: What is the U.S. dollar index?

A: The U.S. dollar index (USDX) measures the value of the U.S. dollar relative to a basket of other major world currencies. It provides a valuable tool for investors and traders to assess changes in global currency markets, such as when one currency is surging or falling against another.

- Q: What factors can affect the USDX value over time?

A: The USDX can be affected by various internal and external factors. Internally, changes in U.S. economic policy, such as interest rates or inflation rates, can cause its value to rise or fall against other currencies. Externally, events taking place worldwide, such as political turmoil or trade disputes, can also impact the index.

- Q: What strategies should I use when trading with or against the U.S. dollar index?

A: When trading with the U.S. dollar index, it is important to consider various factors affecting its value. Investors should use technical analysis techniques such as trend lines and support/resistance levels to identify potential turning points in the index's movements.

Top-Rated Prepaid Credit Cards For Teenagers

What Is The Difference Between Deferred Compensation Plans And 401(k)s?

The Enterprise Ethereum Alliance: What It Is, What You Can Do

Fixed Capital: An Overview

The Top 5 Credit Card Options

Can Two Household Heads Share an Address?

Car Insurance Treats a Total Loss

Small Business Challenges

What Do You Need To Know About Cards?

Minimum Monthly Payment Definition

What Does Reddit Do